The latest news in the world of mergers and acquisitions is that the UK gambling giant William Hill is reported to have teamed up with NYX Gaming Group in order for them to buy OpenBet. The rumored price put on the betting technology developer is $300 million. This comes right after the UK betting operator has announced its withdrawals from the process to remain the Football Association’s “official betting partner”. The FA tripled the cost of the deal to an estimated £2 million a year.

OpenBet has over 15 years of experience in the field of developing gaming platforms with customers including PMU in France, Danske Spil in Denmark and BCLC in Canada. Currently, the company is owned by Vitruvian Partners. They were bought out back in 2011 for £208 million. There have been reports of Morgan Stanley being appointed to handle the potential sale, though those have not been confirmed by officials from either of the parties involved.

OpenBet has over 15 years of experience in the field of developing gaming platforms with customers including PMU in France, Danske Spil in Denmark and BCLC in Canada. Currently, the company is owned by Vitruvian Partners. They were bought out back in 2011 for £208 million. There have been reports of Morgan Stanley being appointed to handle the potential sale, though those have not been confirmed by officials from either of the parties involved.

NYX Interactive is Stockholm based. The company was established in 2006 and today offers a number of operating systems for casinos and other online games. The group develops, operates, and manages a rather huge portfolio of online games, including casino, bingo, poker, sports betting, and lottery. In late 2011 they became part of the NYX Gaming Group with their acquisition of one of the leading online games developers – NextGen Gaming (based in Sydney, Australia).

Another titan in the field – Playtech – is expected to enter the game as it is already one of the main players in the industry. This is likely the reason for William Hill to be giving NYX a shoulder – bookies are not fans of the idea of Playtech dominating the market more than it already does. Something that will certainly be more the case if they were to win OpenBet over.

The potential joint venture of William Hill and NYX comes after a recent row of mergers on the British gambling market – Coral & Ladbrokes, Betfair and Paddy Power – it seems to be the going trend. William Hills even made an offer of £744m to buy out competitor 888 Holdings but the offer was rejected by the shareholders. We all know the benefits of mergers and acquisitions, so none of this comes as a surprise.

We have hunted down some expert’s opinions on the topic to shed some light on the overall feeling about the possible acquisition. David Jennings (analyst at Davy Research, Ireland’s leading provider of wealth management, asset management, capital markets and financial advisory services) believes that from investor’s viewpoint, the market cannot be convinced by the strategic benefits of the merger – the numbers still have to be right, guaranteeing steady returns. Something that is not the case as we speak.

Wawrick Bartlett from Global Betting and Gaming Consultants is more concerned with the fate of existing OpenBet members. “The current customers of the OpenBet sports book will have concerns that if ownership fell into a competitor’s hands, they may lose some integrity over customers’ data.”. He is also supporting the point that from financier’s standpoint there are things to be cleared before the deal can potentially go ahead. Anyone with a background in the gambling industry would know though, that things here are not always done for profit. Limiting the reach of Playtech might prove a good enough reason for the bookmaker to proceed with the acquisition regardless of fiscal benefits (or the lack of such).

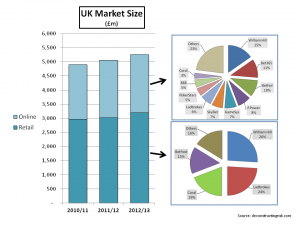

If you know anything about finance it will be no news to you that gambling is a massive market worldwide. The UK is no exception with one of the fastest-growing segments being online gambling, which generated £1.45 billion for bookmakers in the five months between November 2014 and March 2015.

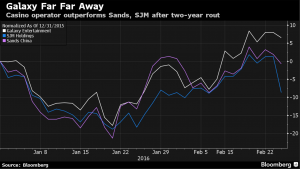

If you know anything about finance it will be no news to you that gambling is a massive market worldwide. The UK is no exception with one of the fastest-growing segments being online gambling, which generated £1.45 billion for bookmakers in the five months between November 2014 and March 2015. Another industry titan from the area – Galaxy Entertainment Group Ltd, reported their last year’s results as well this week. Their fourth-quarter earnings fell 7% compared to the year before. Not an optimum result as well but still – far less than the decline analysts were predicting a few months ago. Here as well, the main reason for their improved records is the shift of focus from high-rollers to smaller stakes players and non-gambling resorts. This year they are planning on developing a resort on land site in Hengqin (an island in the south of of Zhuhai, Guangdong province, just 200 meters from Macau). Galaxy shares have risen 6.5 percent so far this year, making it the only one among all Macau casino stocks that is on the rise and the best performer in the Hang Seng Index – a sure indication that whatever their strategy is, it is working.

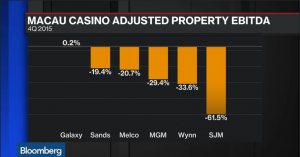

Another industry titan from the area – Galaxy Entertainment Group Ltd, reported their last year’s results as well this week. Their fourth-quarter earnings fell 7% compared to the year before. Not an optimum result as well but still – far less than the decline analysts were predicting a few months ago. Here as well, the main reason for their improved records is the shift of focus from high-rollers to smaller stakes players and non-gambling resorts. This year they are planning on developing a resort on land site in Hengqin (an island in the south of of Zhuhai, Guangdong province, just 200 meters from Macau). Galaxy shares have risen 6.5 percent so far this year, making it the only one among all Macau casino stocks that is on the rise and the best performer in the Hang Seng Index – a sure indication that whatever their strategy is, it is working. With the end of 2015, this month many Macau bookmakers have reported their financial results for the year behind. With Chinese authorities’ crackdown on corruption (starting back in late 2014) and the subsequent flee of VIP players, the businesses in the area have suffered losses across the board. This month however seems more promising with results picking up for major players in the industry. This is partly due to the

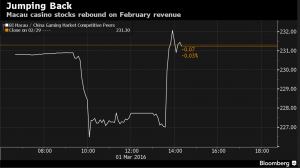

With the end of 2015, this month many Macau bookmakers have reported their financial results for the year behind. With Chinese authorities’ crackdown on corruption (starting back in late 2014) and the subsequent flee of VIP players, the businesses in the area have suffered losses across the board. This month however seems more promising with results picking up for major players in the industry. This is partly due to the  His explanations to the more assuring results are similar to ours – the decision to broaden activities towards non-gamblers that many online and offline operators have been toying with lately. The expansion into new markets and customer types has proved to be working. This is evident looking at the operators that seem to be doing better – they are the ones either having new venues, such as Galaxy, or with a focus on web based activities.

His explanations to the more assuring results are similar to ours – the decision to broaden activities towards non-gamblers that many online and offline operators have been toying with lately. The expansion into new markets and customer types has proved to be working. This is evident looking at the operators that seem to be doing better – they are the ones either having new venues, such as Galaxy, or with a focus on web based activities. Over the past 20 years the

Over the past 20 years the