Without any doubt, 2021 was a rather unusual, very difficult, and challenging year for all major global industries. With the Covid-19 pandemic negatively influencing the global economy, the global casino gambling industry recorded some negative trends, especially in the field of land-based gambling establishments.

According to the latest reports published by acclaimed agencies that follow the latest industry trends, the global casino gambling industry is expected to grow at an annual rate of 5% in the three years from now.

When it comes to the global online gambling market, it is expected to reach a staggering value of $92,9 billion by 2023. The global iGaming industry was valued at around $59 billion as estimated in December 2021. If it grows at the forecasted annual rate, the value of the global iGaming market will double in the next few years.

The growth of the global online gambling scene is fueled by technological advancements that make iGaming much more convenient than gambling at land-based casinos. Naturally, some other factors significantly contribute to the growth of the iGaming scene.

In recent times, we have witnessed new countries and regions in the world intruding friendlier, more lenient gambling laws and regulations, such as the United States. Global digitalization has also been on the rise, especially in Africa and Asia.

With many regions in the world jumping on the digitalization bandwagon, more international companies feel encouraged to expand their businesses and offer their services to wider audiences. These are all crucial factors that contribute to the tremendous growth of the global online gambling scene.

The Growth of the Global Online Gambling Market in 2021

Unlike many other industries, the iGaming industry was positively influenced by the Covid-19 pandemic and different restrictions. As land-based casinos were forced to temporarily shut down their operations, more players turned to iGaming venues.

To bridge different psychological, social, and financial crises, players engaged in various online gambling activities. According to the latest reports, the Covid-19 pandemic has surged customers’ interest in online gambling activities in all key iGaming markets.

In response to the temporary closures of land-based gambling establishments, many renowned casino operators decided to go digital. We also witnessed many online casinos expanding their offering by adding more instant-win and classic table games into their libraries.

According to most experts, the online sports betting industry will be the fastest-growing iGaming segment, followed by online casinos and other forms of online gambling activities.

In the years to come, the growth of the online gambling market will most likely be fueled by introducing more convenient cashless payment options and more innovative betting models.

To keep their customers engaged, we also expect to see renowned gambling operators offering more interesting tournaments and more rewarding bonuses and promotions. As bonus incentives become bigger and better, customer engagement increases.

The Fastest-Growing iGaming Market – North America

In the second quarter of 2021, the total gambling revenue in the United States surpassed $13,6 billion according to a report released by the American Gaming Association. In the third quarter of 2019, the total gambling revenue in the US gambling market reached over $11,1 billion.

Therefore, the revenue increased by over 22% in the second quarter of 2021, despite the fact the Covid-19 pandemic caused a major recession. When we compare the US online gambling scene with other key iGaming markets, it is quite obvious that the United States is home to the fastest-growing online gambling scene.

This does not come as a surprise considering that online casino and sports betting activities have been legalized in many states, including Pennsylvania, Michigan, Delaware, New Jersey, West Virginia, Illinois, Colorado, Arizona, and Louisiana.

In other words, the number of licensed online casinos and sports betting sites in the United States increases every day, so is the US iGaming market’s revenue. The increasing liberalization and regularization of online gambling activities in the United States will most certainly fuel the market’s growth and expansion in the months to come.

Key iGaming Markets in 2021

In Europe, the United Kingdom is the ultimate leader when it comes to online casino gambling activities. According to a report by Statist, around 32% of adult Brits engage in online gambling activities on a regular basis.

Moreover, over twenty-five million adult Brits fuel the tremendous growth of the United Kingdom’s gambling scene. Around ten million British gamblers engage in online gambling activities. With this in mind, the UK’s gambling industry is expected to grow at an exponential rate in the next twelve months.

Other key iGaming markets, such as Canada, Australia, and Italy are also expected to grow in the months to come. While their gambling laws and regulations are not as lenient as those in the United Kingdom, the number of online gamblers has been on the rise for quite a while now. The bottom line, the iGaming sector in 2021 suffered no major pitfalls, unlike its land-based counterpart and most other industries.

When people want to make some money on the side, they look online. Fortunately, the internet offers all sorts of ways for people to earn some extra cash. One of the most popular ways of doing this is by trading currencies. There are two types of currency: fiat currencies, which are traditional currencies such as the dollar, the pound sterling and the euro;

When people want to make some money on the side, they look online. Fortunately, the internet offers all sorts of ways for people to earn some extra cash. One of the most popular ways of doing this is by trading currencies. There are two types of currency: fiat currencies, which are traditional currencies such as the dollar, the pound sterling and the euro;  Contracts for Difference (CFDs) are a popular way of making money online these days. Even though its mechanics seem a bit complicated, and the concept might be somewhat vague for many, they are not something so sophisticated. In this article, we will not explain in detail how CFDs work – we will just assume that you are familiar with the subject matter. If not, there are plenty of online articles that can help you –

Contracts for Difference (CFDs) are a popular way of making money online these days. Even though its mechanics seem a bit complicated, and the concept might be somewhat vague for many, they are not something so sophisticated. In this article, we will not explain in detail how CFDs work – we will just assume that you are familiar with the subject matter. If not, there are plenty of online articles that can help you –  William Hill is not only one of the world’s leading gaming and betting companies but it’s the largest and most influential one in the UK. Their online casinos also pave the way in iGaming. They are a true success but could that all tumble down in the blink of an eye?

William Hill is not only one of the world’s leading gaming and betting companies but it’s the largest and most influential one in the UK. Their online casinos also pave the way in iGaming. They are a true success but could that all tumble down in the blink of an eye? This week, online players witnessed the launch of arguably the most graphically-enhanced virtual roulette game as of yet. On top of with its visual superiority, Double Ball Roulette stands out with the fact that there are two balls thrown into the wheel and, therefore, two winning numbers each round. In fact, you can make a special bet on whether or not the two balls will fall into the same pocket – a bet which pays 35 to 1. You can even make a ‘Double Ball’ bet for a specific number – it pays 1200 to 1! Furthermore, you can make called bets using the racetrack which is located in a separate window that you can go to by clicking the green ‘Neighbours’ button. The bet range is also pretty nice, starting from £0.10 which is perfect for the low rollers, and going up to £1000 for outside bets – an amount that, in proportion to the minimum bet limit, is perfect for applying progressive betting strategies such as Fibonacci’s or Martingale’s.

This week, online players witnessed the launch of arguably the most graphically-enhanced virtual roulette game as of yet. On top of with its visual superiority, Double Ball Roulette stands out with the fact that there are two balls thrown into the wheel and, therefore, two winning numbers each round. In fact, you can make a special bet on whether or not the two balls will fall into the same pocket – a bet which pays 35 to 1. You can even make a ‘Double Ball’ bet for a specific number – it pays 1200 to 1! Furthermore, you can make called bets using the racetrack which is located in a separate window that you can go to by clicking the green ‘Neighbours’ button. The bet range is also pretty nice, starting from £0.10 which is perfect for the low rollers, and going up to £1000 for outside bets – an amount that, in proportion to the minimum bet limit, is perfect for applying progressive betting strategies such as Fibonacci’s or Martingale’s. This is a game that was launched a couple of months ago by the software provider SG Interactive. What’s unique about it is that there’s an extra slot on the wheel that you can bet on and win a pot of up to x200 times your original bet. The game has a relatively nice betting range which starts from £1 and goes up to £500 for outside bets. The maximum you can bet on the Key Bet sector is £250 which means that you can win a maximum of £50,000 in a round – a sum that is not offered by many roulette games, no matter if you play online or at a land-based casino. Some other important details about the game are that there is only one zero on the wheel and that there’s a racetrack so that you can easily make neighbour bets.

This is a game that was launched a couple of months ago by the software provider SG Interactive. What’s unique about it is that there’s an extra slot on the wheel that you can bet on and win a pot of up to x200 times your original bet. The game has a relatively nice betting range which starts from £1 and goes up to £500 for outside bets. The maximum you can bet on the Key Bet sector is £250 which means that you can win a maximum of £50,000 in a round – a sum that is not offered by many roulette games, no matter if you play online or at a land-based casino. Some other important details about the game are that there is only one zero on the wheel and that there’s a racetrack so that you can easily make neighbour bets. NewAR Roulette is one of the latest titles by the software giant Playtech that was launch roughly 2-3 months ago. What’s different about it is that it allows you to make two mixed bets: Even + Red and Odd + Black bets. These unique betting options pay 3:1 and allow for bets ranging from a minimum of £1 and a maximum of £500. The table maximum for this game is £1000. There’s only one zero and there’s also a racetrack which allows you to easily place neighbour bets and the called bets Tier, Voisins du Zero and Orphelins.

NewAR Roulette is one of the latest titles by the software giant Playtech that was launch roughly 2-3 months ago. What’s different about it is that it allows you to make two mixed bets: Even + Red and Odd + Black bets. These unique betting options pay 3:1 and allow for bets ranging from a minimum of £1 and a maximum of £500. The table maximum for this game is £1000. There’s only one zero and there’s also a racetrack which allows you to easily place neighbour bets and the called bets Tier, Voisins du Zero and Orphelins.

OpenBet has over 15 years of experience in the field of developing gaming platforms with customers including PMU in France, Danske Spil in Denmark and BCLC in Canada. Currently, the company is owned by Vitruvian Partners. They were bought out back in 2011 for £208 million. There have been reports of Morgan Stanley being appointed to handle the potential sale, though those have not been confirmed by officials from either of the parties involved.

OpenBet has over 15 years of experience in the field of developing gaming platforms with customers including PMU in France, Danske Spil in Denmark and BCLC in Canada. Currently, the company is owned by Vitruvian Partners. They were bought out back in 2011 for £208 million. There have been reports of Morgan Stanley being appointed to handle the potential sale, though those have not been confirmed by officials from either of the parties involved. If you know anything about finance it will be no news to you that gambling is a massive market worldwide. The UK is no exception with one of the fastest-growing segments being online gambling, which generated £1.45 billion for bookmakers in the five months between November 2014 and March 2015.

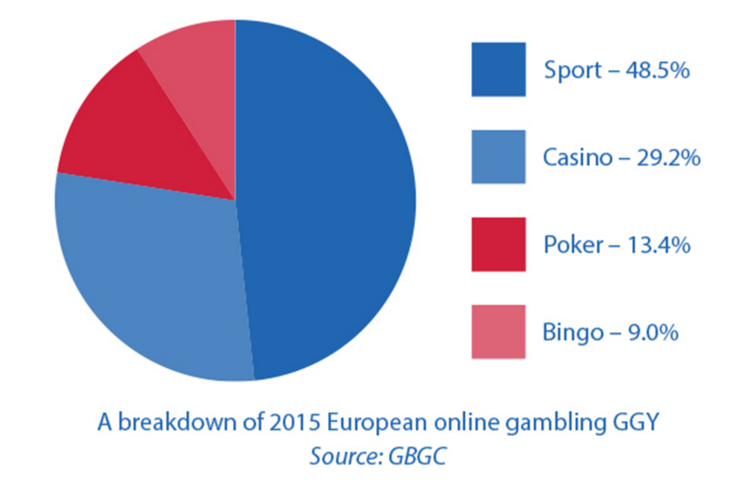

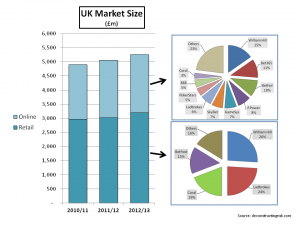

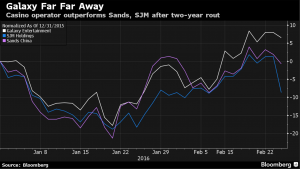

If you know anything about finance it will be no news to you that gambling is a massive market worldwide. The UK is no exception with one of the fastest-growing segments being online gambling, which generated £1.45 billion for bookmakers in the five months between November 2014 and March 2015. Another industry titan from the area – Galaxy Entertainment Group Ltd, reported their last year’s results as well this week. Their fourth-quarter earnings fell 7% compared to the year before. Not an optimum result as well but still – far less than the decline analysts were predicting a few months ago. Here as well, the main reason for their improved records is the shift of focus from high-rollers to smaller stakes players and non-gambling resorts. This year they are planning on developing a resort on land site in Hengqin (an island in the south of of Zhuhai, Guangdong province, just 200 meters from Macau). Galaxy shares have risen 6.5 percent so far this year, making it the only one among all Macau casino stocks that is on the rise and the best performer in the Hang Seng Index – a sure indication that whatever their strategy is, it is working.

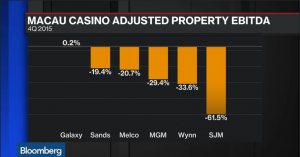

Another industry titan from the area – Galaxy Entertainment Group Ltd, reported their last year’s results as well this week. Their fourth-quarter earnings fell 7% compared to the year before. Not an optimum result as well but still – far less than the decline analysts were predicting a few months ago. Here as well, the main reason for their improved records is the shift of focus from high-rollers to smaller stakes players and non-gambling resorts. This year they are planning on developing a resort on land site in Hengqin (an island in the south of of Zhuhai, Guangdong province, just 200 meters from Macau). Galaxy shares have risen 6.5 percent so far this year, making it the only one among all Macau casino stocks that is on the rise and the best performer in the Hang Seng Index – a sure indication that whatever their strategy is, it is working. With the end of 2015, this month many Macau bookmakers have reported their financial results for the year behind. With Chinese authorities’ crackdown on corruption (starting back in late 2014) and the subsequent flee of VIP players, the businesses in the area have suffered losses across the board. This month however seems more promising with results picking up for major players in the industry. This is partly due to the

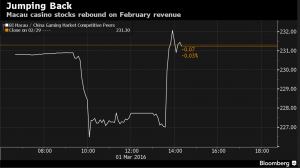

With the end of 2015, this month many Macau bookmakers have reported their financial results for the year behind. With Chinese authorities’ crackdown on corruption (starting back in late 2014) and the subsequent flee of VIP players, the businesses in the area have suffered losses across the board. This month however seems more promising with results picking up for major players in the industry. This is partly due to the  His explanations to the more assuring results are similar to ours – the decision to broaden activities towards non-gamblers that many online and offline operators have been toying with lately. The expansion into new markets and customer types has proved to be working. This is evident looking at the operators that seem to be doing better – they are the ones either having new venues, such as Galaxy, or with a focus on web based activities.

His explanations to the more assuring results are similar to ours – the decision to broaden activities towards non-gamblers that many online and offline operators have been toying with lately. The expansion into new markets and customer types has proved to be working. This is evident looking at the operators that seem to be doing better – they are the ones either having new venues, such as Galaxy, or with a focus on web based activities.